Are you curious to know what will be the future target of Suzlon share price? Let us talk about the Suzlon Share Price Target 2024 to 2030 in today\’s article. This article will be very interesting as Suzlon Energy has been in the news for the past few years. Let us try to solve the questions. We are confident that you will not find the information provided in this article anywhere else. Read the article till the end and you will get good knowledge.

We will get answers to many questions today as well as discuss in depth the Suzlon share price target 2025 to 2030 and 2040 and the factors that could affect it. We will discuss the history and current status of Suzlon Energy Limited. We will discuss topics like financial results, share price history, shareholding pattern, industry growth, company growth, etc.

Suzlon Energy Ltd Overview

Suzlon Energy Limited is a leading global provider of renewable energy solutions, headquartered in Pune, India. Founded in the year 1995 by Tulsi Tanti, the company specializes in wind energy and has expanded its operations to include solar energy, in the early years Suzlon was one of the top 5 companies in the world dealing in wind power.

Suzlon provides services and products of wind turbine manufacturing, installation and maintenance. Suzlon Company is known for its wind turbine technology, producing a variety of turbine models designed to optimize efficiency and reduce costs. Suzlon\’s global presence spans its operations in about 18 countries.

Apart from wind power, Suzlon also plays an important role in solar power projects by contributing to the diversification of its renewable energy portfolio which can benefit it immensely in the future.

Suzlon company has been focusing more on research and development for a long time. Currently, Suzlon\’s orders are increasing due to new wind tenders and solar energy incentives of the government.

Also Read: TTML Share Price Target

Major Products

- Wind Turbines

- Wind Turbine Components

- Solar Panels

Major Services

- Wind Farm Development

- Operation and Maintenance

- Energy Storage Solutions

- Consultancy and Engineering

Suzlon Energy Ltd Profile

| Name | Details |

|---|---|

| Company Name | Suzlon Energy Limited |

| Company Type | Public |

| Founded | 1995 |

| Founder | Tulsi Tanti |

| Traded as | NSE: SUZLON BSE: 532667 |

| ISIN | INE040H01021 |

| Headquarters | Pune, India |

| Number of employees | 5800 |

| Area served | Worldwide |

| Website | www.suzlon.com |

Also Read: Urja Global Share Price Target

Suzlon Share Price Target

Suzlon Energy Limited was listed in the stock market in the year 2005 and its share value was around 123 rupees. Suzlon share price was falling since last years due to many reasons. There has been an increase in it since the last few months and due to this a positivity is being seen within the investors as well.

We will look at the Suzlon share price target which include Suzlon share price target 2024, Suzlon share price target 2025, Suzlon share price target 2026, Suzlon share price target 2030 and Suzlon share price target 2040 respectively and in depth.

Also Read: Jio Financial Services Share Price Target

Suzlon Share Price Target 2024, 2025 to 2030 and 2040

| Year | 1st Target | 2nd Target |

|---|---|---|

| 2024 | ₹ 70.25 | ₹ 79.10 |

| 2025 | ₹ 84.20 | ₹ 92.35 |

| 2026 | ₹ 99.55 | ₹ 105.10 |

| 2027 | ₹ 113.25 | ₹ 118.40 |

| 2028 | ₹ 129.10 | ₹ 133.25 |

| 2029 | ₹ 145.70 | ₹ 150.40 |

| 2030 | ₹ 165.60 | ₹ 169.15 |

| 2040 | ₹ 480.20 | ₹ 514.50 |

Let us now understand the stock price target in details. We will understand Suzlon Share Price Target 2024, Suzlon Share Price Target 2025, 2026 and 2030 in details. Then we will take a look at Suzlon Shares Price Target 2040.

Also Read: IOC Share Price Target

Suzlon Share Price Target 2024

| Year | 1st Target | 2nd Target |

|---|---|---|

| 2024 | ₹ 70.25 | ₹ 79.10 |

The year 2024 is proving to be a golden year for Suzlon Limited as the share price of Suzlon started to rise at the beginning of the year and even after half of the year, it is showing a good growth. Investors are investing in good proportion due to very good positive impact. If good growth is seen till the end of 2024 then it is a green light for the future.

In the year 2024, Suzlon Share Price Target 2024 can be around 70.25 rupees and second target can be around 79.10 rupees.

Also Read: MRF Share Price In 2024, 2025, 2026, 2030 & 2050

Factors Affecting Suzlon Share Price Target 2025

Currently Suzlon share price has seen a huge increase. In the last one year, there has been a lot of positivity in it and the investors have got a good amount of return. If the enthusiasm of the investor to invest in the company is high, then the share price of the company goes up and it is being seen with Suzlon. Investors\’ positive view could propel Suzlon share price to highs in 2025.

Looking at the market now, it seems that the Sensex will touch 1 lakh in the near future, which indicates that the share market is going to go higher in the near future. This point may affect the Suzlon share price in 2025.

Also Read: Reliance Home Finance Share Price Target

Suzlon Share Price Target 2025

| Year | 1st Target | 2nd Target |

|---|---|---|

| 2025 | ₹ 84.20 | ₹ 92.35 |

The coming time is favorable for the stock market but it also has a big chance for companies working in the solar energy and renewable energy sector. The whole world is working towards renewable energy today and India is moving the fastest in it. Suzlon Energy\’s global presence gives it the opportunity to expand its business to a greater extent.

The number of solar projects is going to increase in the year 2025 and which can benefit the Suzlon Ltd. Today there are big power projects and solar projects going on in India and many countries of the world. Suzlon Company can be said to be a monopoly company in solar and wind turbines.

According to our research, Suzlon Share Price Target 2025 can be around rupees 84.20 and second target can be around rupees 92.35 possible.

Also Read: FCS Software Share Price Target

Suzlon Share Price Target 2026

| Year | 1st Target | 2nd Target |

|---|---|---|

| 2026 | ₹ 99.55 | ₹ 105.10 |

Suzlon is working very well in wind turbines and services, the results of which can be seen in the near future. The company\’s net profit was showing a loss till the financial year 2021/22 which has turned into profit for the last 2 years. If the company shows good profit in the coming time too, there are chances of increase in share price and good returns.

In the year 2026, Suzlon Share Price Target 2026 can be around 99.55 rupees and second target can be around 105.10 rupees possible in the year of 2026.

Factors Affecting Suzlon Share Price Target 2030

Increasing global demand for clean energy sources can drive growth and positively impact share prices. Supportive policies and subsidies for renewable energy projects can boost Suzlon\’s financial performance and investor confidence.

Broader economic factors, including interest rates, inflation, and overall economic growth, can impact the company\’s performance and share price. Fluctuations in the prices of traditional energy sources (like oil and gas) can affect the competitiveness of renewable energy solutions.

Suzlon Share Price Target 2030

| Year | 1st Target | 2nd Target |

|---|---|---|

| 2030 | ₹ 165.60 | ₹ 169.15 |

In the future, government policies and global relationships will determine how fast the renewable energy sector will grow. Suzlon company is trying hard to strengthen its position through its management.

The coming year 2030 could be important for long-term investors. So, in this article, we have paid more attention to the share price target for the year 2025 and 2030. The possibilities that the company can take itself to a new height by the year 2030 cannot be ruled out.

Take all things into consideration, Suzlon Share Price Target 2030 can be around 165.60 rupees and second target can be around 169.15 rupees.

Suzlon Share Price Target 2040

| Year | 1st Target | 2nd Target |

|---|---|---|

| 2040 | ₹ 480.20 | ₹ 514.50 |

Long-term forecasting is difficult and riskier because many factors play a role in the stock market and only come into play when the time comes. However, Suzlon\’s current status and future growth can be predicted based on the fundamentals and technical analysis.

According to technical analysis, Suzlon Share Price Target 2040 can be around 480.20 rupees and second target can be around 514.50 rupees possible.

Also Read: Vivanta Industries Share Price Target

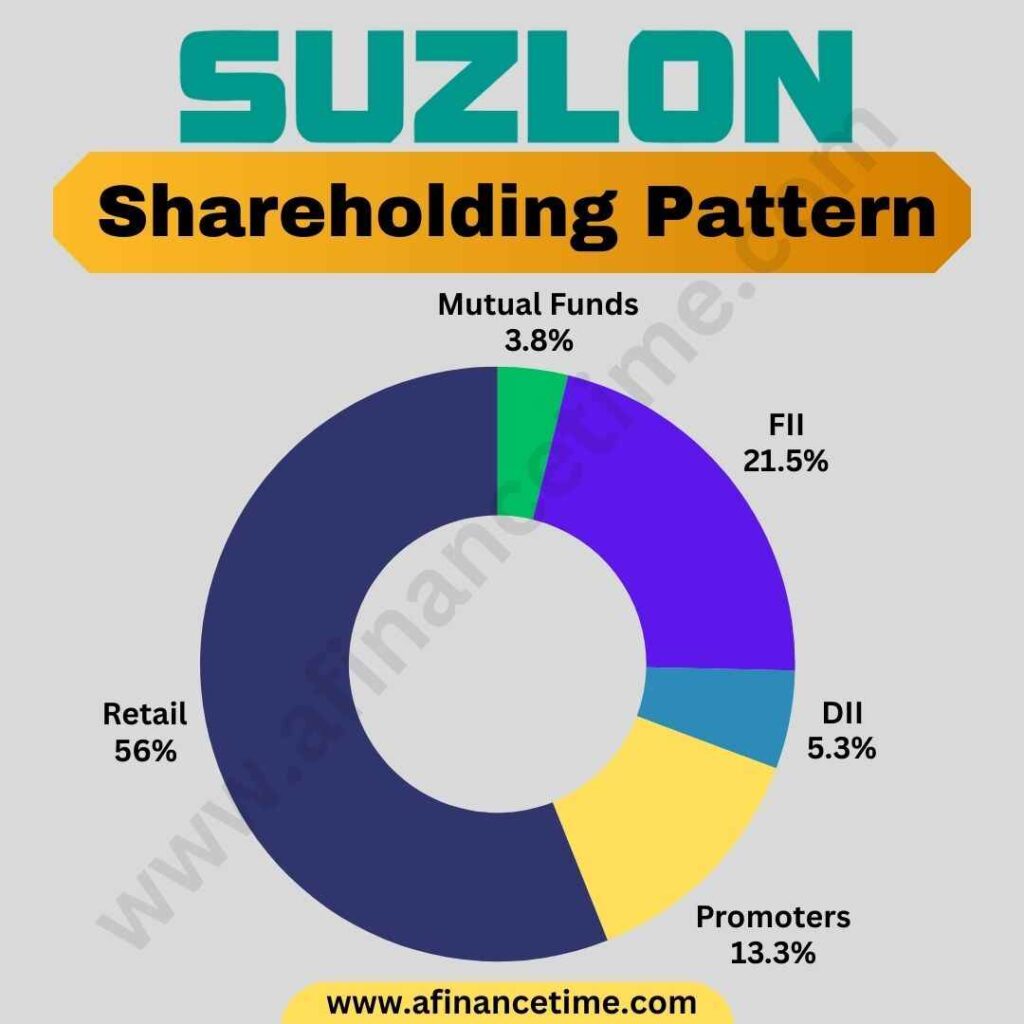

Suzlon Energy Ltd Shareholding Pattern

Suzlon Energy Ltd Fundamentals

It is necessary to have strong fundamentals behind the growth of the company. If there are strong fundamentals, investors invest in them and due to this the share price also increases. Here we take a look at Suzlon\’s fundamentals in the table below.

| Segment | Details |

|---|---|

| Market Cap | 75,263 Cr |

| P/E Ratio | 110.40 |

| P/B Ratio | 19.78 |

| ROCE | 126.40% |

| ROA | 36.90% |

| EV/EBITDA | 46.52 |

| Dividend Yield | — |

| Debt to Equity | 1.64 |

| Op. Profit Margin | 7.03% |

| Net Profit Margin | 60.24 |

Also Read: Kellton Tech Share Price Target

Suzlon Energy Ltd Financial Results

- Mar’22 : In the financial year 2021/22, Suzlon Energy Limited Company generated a total revenue of 4040 crores. Net profit after deducting tax and expenses was seen in the loss around -912 crores.

- Mar’23 : In the financial year 2022/23, Suzlon Energy Limited Company generated a total revenue of 3538 crores. After deducting expenses and taxes, the net profit was seen around 2162 crores.

- Mar’24 : In the financial year 2023/24, Suzlon Energy Limited Company generated a total revenue of around 3800 crores. After deducting expenses and taxes, the net profit was seen around 93.9 crores.

Suzlon Energy Ltd Share Price History

From 2019 to 2023, the share price of Suzlon Energy Limited is seen at rupees 10 or even below. A steady rise in the share price is seen from mid-2023 due to which Suzlon share price has reached around rupees 70 at present.

The company has almost made a loss in the last 18 years as a result of which the share price was rupees 123 in 2005 and has fallen to rupees 10 in 2019.

Also Read: Tata Motors Share Price Target

Suzlon Energy Ltd History

The company was established in the year 1995 by Tulsi Tanti. Within 10 years, the company made great strides and in the year 2005 the company brought the IPO at a price of rupees 123 and in the year 2005, Tulsi Tanti became the fourth richest person in India. Suzlon is not a small company it was the fifth largest wind energy company in the world.

Suzlon\’s business was to manufacture wind turbines and provide related services. In the year 2005 Suzlon owner Tulsi Tanti thought of manufacturing windmill parts and bought 2 foreign companies. He sold shares and took loans to buy both companies.

Now due to the financial crisis in the year 2008, the condition of the company started to deteriorate and it went into losses. Due to which the company did not have money to pay the loan interest.

In the year 2011, the government stopped giving incentives for wind energy and from 2011 to 2015, no government tender was seen in wind energy. The government shifted its focus from wind energy to solar energy due to which Suzlon faced huge losses.

In 2016 the company started selling its assets to repay its loans and interest. By 2022, the company has reduced its debt from rupees 20,000 crore to rupees 2,000 crore by selling its assets.

Is Suzlon Energy Ltd Multibagger ?

Last 2 years return of Suzlon company is very good but company\’s financial result and company’s income is still very poor. The company has reduced its debt and may turn a profit soon.

Suzlon has given returns of 260% in last 1 year and 75% till half of year 2024. You can judge for yourself from the statistics whether Suzlon is Multibagger or not.

Also Read: Axita Cotton Share Price Target

Future Potential For Suzlon Energy Ltd

The Indian government shifted its focus from wind power, now again the government is focusing on wind power in 2023 and the government has announced that it will issue tenders for 10 GW per year by 2028. Which can directly benefit Suzlon Energy which can be called a potential for Suzlon.

The government is working on a green hydrogen project which will require 125 GW of energy per year and which will be generated from renewable sources such as solar or wind energy. Due to all these positive reasons, the order book of Suzlon has been increasing for some time and this can also be called as an opportunity for the company in the future.

Also Read: Salasar Techno Share Price Target

Risk and Consideration

Risk : Suzlon Energy has given good returns in recent times but let us talk a little about the risks hidden within it. The company has sold many of its assets but still has debt on the company. The company will have to beat many competitors in wind energy in the future. Wind power is highly dependent on government tenders and does most of the work only on government schemes, and if the government bends the tenders in the future, it could affect the company.

In 2011, the government stopped the incentives given to wind Energy, due to which the Suzlon company suffered huge losses. Such risks may be seen in the future.

Consideration : We have to consider many things here. Considering the company’s huge returns in a few years, investing can be risky. The fundamentals of the company should be considered and invested. One should consider the impact of new schemes coming from the government and always get updated news with time. Suzlon is not yet a stable company so before investing in it the risk should be understood.

In 2011, the government stopped the incentives given to wind Energy, due to which the Suzlon company suffered huge losses. Such risks may be seen in the future.

Also Read

Conclusion

Suzlon Energy Limited, a major player in renewable energy, has shown promising recovery and growth, particularly in wind and solar sectors. However, risks include ongoing debt and reliance on government incentives. Despite past financial challenges, Suzlon\’s commitment to innovation and strategic market positioning could drive substantial future gains. Long-term investors should consider both potential rewards and inherent risks, staying informed on industry trends and governmental policies to make well-rounded investment decisions.

FAQs

Suzlon Energy Share Price Target 2025

According to fundamentals and technical analysis and from our research, Suzlon Energy Share Price Target 2025 can be around rupees 84.20 and second target can be around rupees 92.35 possible.

Suzlon Energy Share Price Target 2030

Take all things into consideration, Suzlon Energy Share Price Target 2030 may be around 165.60 rupees and second target may be around 169.15 rupees.

Suzlon Energy Share Price Target 2040

In the year 2040, Suzlon Share Price Target 2040 can be around 480.20 rupees and second target can be around 514.50 rupees possible.

What is the share price of Suzlon in 2030?

In the year 2030, Suzlon Share Price Target 2030 may be possible around 165.60 rupees and second target may be around 169.15 rupees in the year of 2030.

Does Suzlon Energy has a future?

Currently there is an opportunity to grow with Suzlon Energy based on the wind energy policy introduced by the Government of India and the ongoing scheme in solar energy.

Is Suzlon profitable?

The financial results of the Suzlon company have been positive in the last 2 years. In which the main source of income is the sale of assets of the company.

Is Suzlon recovering?

Suzlon Company has paid off a lot of debt by selling its assets and the chances of its growth in the future are looking good.

Disclaimer: The information provided by us is for education only. Not to be considered as investment advice of any kind. Read More….