Do you want to dive into the future of Salasar Techno\’s share price? If Yes, So this article is for you to read completely for all information about Salasar Techno Share Price Target 2024, 2025, 2026, 2027 and 2030. In this article we will look at the Salasar Techno share price forecast with short term, mid term and long term targets.

About Salasar Techno Engineering Ltd

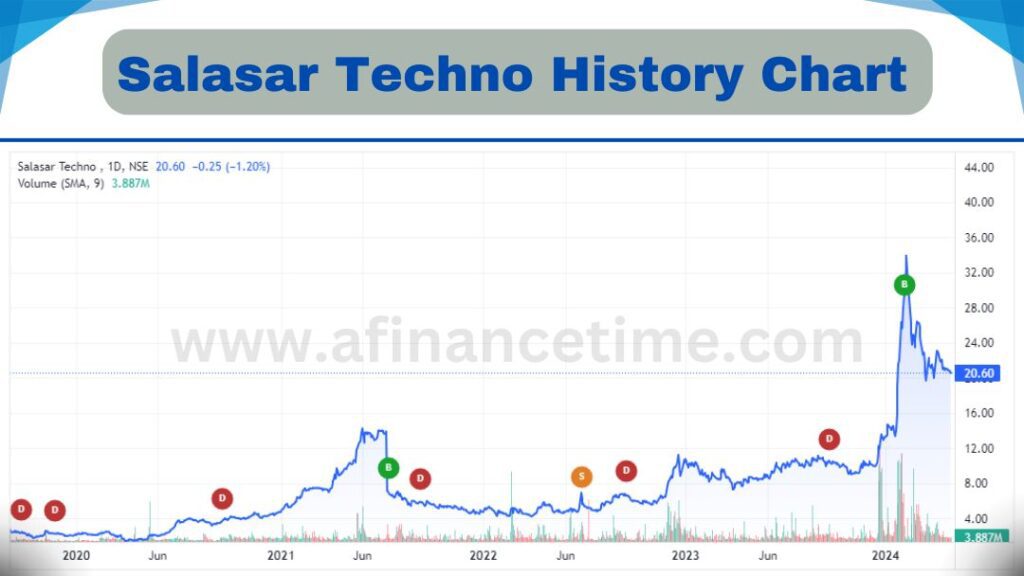

Salasar Techno is a new company in the stock market which was established in 2001 and listed in stock exchange in 2017. If we talk about the last five years of Salasar Techno, it has seen a very good return which is almost more than 900%.

Salasar Techno Engineering Ltd is an Indian company primarily engaged in providing customized steel fabrication and infrastructure solutions. The company specializes in manufacturing telecommunication towers, power transmission towers, substation structures, solar panel mounting structures, and other related products for various industries.

The company has a strong presence in India and has also expanded its operations globally, exporting its products to several countries. In addition to its core business of steel fabrication, Salasar Techno Engineering has also ventured into the renewable energy sector by providing solutions for solar power projects, including mounting structures for solar panels.

We will look at the Salasar Techno share price target 2024, 2025, 2026, 2027 and 2030 respectively through the company\’s fundamental and technical information.

Also Read: Vivanta Industries Share Price Target 2025, 2026, 2027, 2030 & 2040

Company Profile

| Name | Information |

|---|---|

| Company Name | Salasar Techno Engineering Ltd |

| Company Type | Public |

| Traded as | NSE: SALASAR BSE: 540642 |

| Industry | Engineering |

| Founded | 2001 |

| Market Cap | 3,245 Cr |

| P/E Ratio | 65.29 |

| P/B Ratio | 5.89 |

| ROE | 11.77% |

| Debt to Equity | 0.68 |

| Revenue | 1,000.10 Cr |

| Net Profit Margin | 4.01% |

| Operating Cash Flow | -3.84 Cr |

| Website | www.salasartechno.com |

Salasar Techno Share Price Target 2024

| Year | 1st Target | 2nd Target | 3rd Target |

|---|---|---|---|

| 2024 | ₹ 22.70 | ₹ 23.70 | ₹ 24.20 |

Salasar Techno Engineering Ltd is recognized for its expertise in steel fabrication and its contributions to various sectors such as telecommunications, power, and renewable energy. The demand for their products is likely to increase in the future.

It has support from 19.70 to 20.10 rupees at present, if the support breaks and moves upwards, So we can see first Salasar Techno Share Price Target 2024 can be 22.70 rupees. Then Salasar Techno share price target 2024, second and third targets could be 23.70 and 24.20 rupees respectively.

Salasar Techno Share Price Target 2025

| Year | 1st Target | 2nd Target | 3rd Target |

|---|---|---|---|

| 2025 | ₹ 25.30 | ₹ 26.60 | ₹ 27.85 |

Given the Salasar Techno company\’s track record of consistently surpassing market expectations and its strategic initiatives to penetrate new markets, there is a strong possibility of the company\’s share price reaching new heights in the near future. Salasar Techno is actively striving to enhance its financial position by implementing measures to boost sales and streamline operations, paving the way for improved profitability and sustained growth.

In 2025 we can look at three targets of salasar techno, The first Salasar Techno Share Price Target 2025 can be 25.30 rupees. The second and third target of salasar techno share could be 26.60 and 27.85 rupees respectively

Salasar Techno Share Price Target 2026

| Year | 1st Target | 2nd Target | 3rd Target |

|---|---|---|---|

| 2026 | ₹ 29.60 | ₹ 30.40 | ₹ 32.50 |

With increasing infrastructure development projects, the demand for construction work is expected to increase in the coming years, creating opportunities for growth and expansion in the industry that companies like Salasar Techno can generate good income.

Salasar Techno Share Price Target 2026 is 29.60 rupees, Another target could be 30.40 and 32.50 rupees in end of the year 2026.

Salasar Techno Share Price Target 2027

| Year | 1st Target | 2nd Target | 3rd Target |

|---|---|---|---|

| 2027 | ₹ 33.90 | ₹ 34.75 | ₹ 36.10 |

Capitalizing on the promising future of renewable energy, the Salasar Techno company stands poised to leverage this opportunity for both financial gain and enhanced reputation. By investing in sustainable solutions, it can secure a profitable and esteemed position in the market. Salasar Techno gradually taking his company forward which shows the prospects of good returns in future.

As you must have seen the target price in the above table, the first Salasar Techno Share Price Target 2027 can be 33.90 rupees. Second target is 34.75 rupees and third target can be 36.10 rupees.

Salasar Techno Share Price Target 2030

| Year | 1st Target | 2nd Target | 3rd Target |

|---|---|---|---|

| 2030 | ₹ 48.25 | ₹ 50.35 | ₹ 52.10 |

Long-term forecasting in share market is difficult as many factors play a role in it like economy growth, inflation, global markets, currency rates, global economy, political instability etc. Salasar Techno is gradually making good progress in his field and is also trying to improve the financial background of his company.

In 2030, Salasar Techno Share Price Target 2030 is 48.25 rupees. After the first target is hit, the second target can be 50.35 rupees and third target can be 52.10 rupees.

Also Read: Kellton Tech Share Price Target 2025, 2030, 2035, 2040 & 2050

Salasar Techno Engineering Ltd Fundamentals

Now we will talk about Salasar Techno fundamentals, financial results and stock price history in simple words. For the growth of share price of any company, it is very important to have proper financial condition. If the work is done with proper management and keeping the future in mind, the company gets a lot of opportunities to move forward.

Salasar Techno Shareholding Pattern

- Promotors: 63.07%

- Retail and Other: 33.92%

- Foreign Institutions-FII: 3%

Salasar Techno Financial Results

In the FY 2021-22, Salasar Techno total sales were more than 580 crores out of which the net profit after taxes and expenses was 29.34 crores.

Salasar Techno’s total sales in FY 2022-23 were 690 crores which is better than 2022. In 2023, they tried to cut costs which led to a net profit of 32 crores after taxes and expenses.

If we talk about the FY 2023-24, Salasar Techno 1000 crores of sales have been recorded. Excluding expenses and taxes 40 crores net profit deducting.

Salasar Techno Share Price History

Salasar Techno has an all time high of Rs 33.95 and an all time low of Rs 1.41 so far. In the last 52 weeks, the high has been Rs 33.95 and the low has been Rs 8.28. Currently the share price is on a support, if the support breaks and goes down, there is a possibility of a fall and if it goes up, there are chances of hitting a good target.

Also Read: Vivanta Industries Share Price Target 2025, 2026, 2027, 2030 & 2040

Conclusion

Today we talked about Salasar Techno Company in the article. From technical and fundamentals analysis, we will see Salasar Techno Share Price Target 2024 to 2030. We get an overview of the company\’s results and historical share price. Discussed in detail the basic details of the company and the industry of the company.

FAQs

What is the share price target for Salasar in 2025?

Salasar Techno Share Price Target 2025 can be 25.30 rupees. The second and third target of salasar techno share could be 26.60 and 27.85 rupees respectively.

What is the price target for Salasar in 2024?

Salasar Techno Share Price Target 2024 can be 22.70 rupees. Then Salasar Techno share price target 2024, second and third targets could be 23.70 and 24.20 rupees respectively.

What is the future of Salasar Techno?

Currently, the share price of Salasar Techno is at a support lavel. Now it is imperative to research in more depth to buy it. In the article we have shown Salasar Techno company\’s details

Is Salasar a good share to buy?

Yes, but there is a lot of ups and downs in the company. The product of the company is good for the future which can lead to growth.

Disclaimer: All information placed across our website is for information only. We do not advise any investment, take expert opinion before investing….Read More